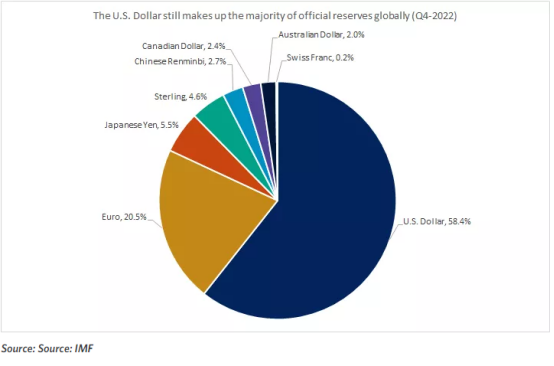

Lots of talk of death of the dollar over the last few weeks, as TotalEnergies purchased a cargo of LNG in yuan from China, China making deals to trade in Yuan, and Russia exploring other currencies to trade oil in due to sanctions.

I believe these calls are VERY premature.

To be a reserve currency you need these 5 things.

1. Trust in the central bank. The U.S. Federal Reserve is one of the most powerful central banks in the world. With the U.S. dollar used for approximately 90% of all of the world's currency transactions, the Fed's sway has a sweeping effect on the valuation of many currencies. In addition, The bulk of official dollar reserves are held in the form of U.S. Treasury securities, which are in high demand by both official and private foreign investors. As of the end of the first quarter of 2021, $7.0 trillion or 33 percent of marketable Treasury securities outstanding were held by foreign investors, both official and private while 42 percent were held by private domestic investors, and 25 percent by the Federal Reserve System. (Federal Reserve data)

Current foreign holders of US debt

2. Liquid Markets. The U.S. dollar has been the dominant currency globally in the strength and stability of the U.S. economy, as well as the deep and liquid financial markets that the U.S. offers. The U.S. has by far the largest bond markets and stock markets globally, and, importantly, the financial markets are highly regulated and offer borrowers and lenders access to a large set of counterparties. These advantages have allowed the U.S. dollar to maintain its dominant position in international trade and finance.

3. Wide Acceptance. Most of the global trade is still conducted in U.S. dollars. The Federal Reserve estimates that between 1999 to 2019, the dollar accounted for 96% of trades in North America, 74% in the Asia-Pacific region, and 79% for the rest of the world. The only region where trade was not dominated by the U.S. dollar was Europe, where the euro remained the preferred trade currency. Global oil trade, which accounts for about 6% of overall trade, is still largely conducted in U.S. dollars. While the dollar may become less of a force here, this sector remains a relatively small part of overall trade and may still use the U.S. dollar in some transactions. (Federal Reserve data)

4. Convertibility. Currency convertibility is the ease with which a country's currency can be converted into gold or another currency. Currency convertibility is important for international commerce as globally sourced goods must be paid for in an agreed-upon currency that may not be the buyer's domestic currency. When a country has poor currency convertibility, meaning it is difficult to swap it for another currency or store of value, it poses a risk and barrier to trade with foreign countries that have no need for the domestic currency. A convertible currency is any nation's legal tender that can be easily bought or sold on the foreign exchange market with little to no restrictions. A convertible currency is a highly liquid instrument as compared with currencies that are tightly controlled by a government's central bank or other regulating authority. (Investopedia)

Chinese Yuan is non-convertible as it is traded in low volumes in the global foreign exchange market and tightly controlled by the government via capital controls that limit the amount of currency that can exit or enter the country.

5. Strong Military. Over the past 300 years, there have been three major empires – the Dutch Empire, British Empire, and American Empire, each characterized by having a reserve currency and a dominant military.

According to Statista, the most powerful military in the world is the United States military. (Statista uses an index with 50 different factors such as military might to budget to give each country a score.)

The top eight most powerful militaries as of January 2022:

United States

Russia

China

India

Japan

South Korea

France

United Kingdom

The 40 countries with the highest military expenditure in 2021

The share of world military expenditure of the 15 countries with the highest spending in 2021

EURODOLLAR MARKET

Not a requirement of a reserve currency, but we have to factor in Eurodollars as it is one of the world’s primary international capital markets.

The term eurodollar refers to U.S. dollar-denominated deposits at foreign banks or at the overseas branches of American banks. Because they are held outside the United States, eurodollars are not subject to regulation by the Federal Reserve Board, including reserve requirements. Dollar-denominated deposits not subject to U.S. banking regulations were originally held almost exclusively in Europe (hence, the name eurodollar). Now, they are also widely held in branches located in the Bahamas and the Cayman Islands.

The fact that the eurodollar market is relatively free of regulation means such deposits can pay higher interest. Their offshore location makes them subject to political and economic risk in the country of their domicile; however, most branches where the deposits are housed are in very stable locations.

To say this market is HUGE is an understatement. In 2016, the Eurodollar market size was estimated at around 13.833 trillion and has only since grown.

IN SUM

Right now there just is no other viable country with the ability to supplant the US dollar as the global reserve currency taking all these factors into account.

Thank you Tracy, this has become a tiresome narrative which seems to be an attempt to drive clicks, rather than discuss the possibilities. Ultimately, the depth and breadth of liquidity and transactability of the dollar are why it has its current position of supremacy and you are correct, there is no other currency that comes close to achieving these requirements.

Nice work Tracy, have a great week!